Highlights

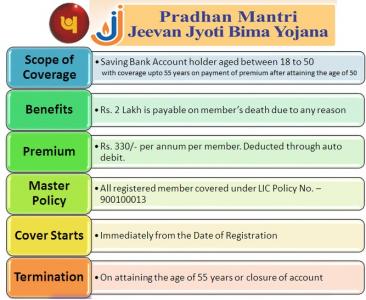

- Life Insurance Cover Of Rs. 2 Lakh.

- Nominee will get Rs. 2 Lakh after death of insured due to any reason.

- Yearly Premium Of Rs. 436/- Year.

- No Need To Submit Health Report or Certificate While Applying.

- Eligible Age to Enroll 18 Years to 50 Years.

- Provided by LIC and Other Life Insurance Companies.

Website

Customer Care

- National Toll Free Number :-

- 18001801111.

- 1800110001.

Information Brochure

|

Overview Of The Scheme

|

|

|---|---|

| Name of Scheme | Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) |

| Launched Date | 9th of May 2015. |

| Scheme Type | Life Insurance Scheme |

| Nodal Ministry | Department of Financial Services. |

| Official Website | JanDhan se JanSuraksha Website. |

| Eligibility | Indian Citizen Between the Age Group Of 18 to 50 Years. |

| Mode Of Apply | Only Offline Mode Available Through The Banks. |

Introduction

- Pradhan Mantri Jeevan Jyoti Bima Yojana is a Life Insurance Scheme of Department Of Financial Services under Ministry Of Finance.

- It is a social security scheme and was launched by Prime Minister Sh. Narendra Modi On 9th Of May 2015 in Kolkata.

- The main objective behind starting Pradhan Mantri Jeevan Jyoti Bima Yojana is to provide social and financial security cover to people of India.

- This scheme is also called "Prime Minister Life Insurance Scheme" or "Pradhan Mantri Jeevan Jyoti Bima Scheme".

- It is a yearly personal life insurance scheme for the people who are uninsured.

- Financial Assistance of Rs. 2,00,000/- will be provided to nominee under Pradhan Mantri Jeevan Jyoti Bima Yojana in case of untimely demise of a insured person.

- Insurance Amount under this scheme is payable irrespective of cause of death of a person.

- This scheme is offered by Life Insurance Corporation of India and other Life Insurance Companies having collaboration with Banks and Post Office.

- It is up to Banks/ Post Offices to engage any Life Insurance Company to implement the scheme for their customers.

- Beneficiary has to pay a very nominal premium amount of Rs. 436/- per year for Pradhan Mantri Jeevan Jyoti Bima Yojana.

- Person can enroll themselves under Pradhan Mantri Jeevan Jyoti Bima Yojana at any point of time in a financial year.

- Premium Amount will be paid through Auto Debit Mode.

- Beneficiary can Visit their Bank or Post Office and get themselves covered under Pradhan Mantri Jeevan Jyoti Bima Yojana.

Benefits

- The following benefits will be provided to a person who is insured under Pradhan Mantri Jeevan Jyoti Bima Yojaa :-

- Personal Insurance Cover of Rs. 2,00,000/-

- Very Nominal Premium of Rs. 436/- per Year.

- Covers Death caused due to any reason.

- Nominee of Policy Holder will get Rs. 2 Lakh in case of Death of Policy Holder.

Eligibility Criteria

- Every Indian Citizen is Eligible.

- The Age of Person should be between 18 Years to 50 Years.

- Beneficiary should have Jandhan Bank Account or Saving Bank Account in any Bank or in a Post Office.

- Bank/ Post Office Account should be linked with the Person's Aadhar Number.

Key Features Of The Scheme

- It is a social security scheme especially focuses on uninsured poor and underprivileged persons.

- Life Insurance is only for 1 year starting from 1st June to 31st May in every year.

- The annual renewal date of the scheme is 1st of June in every upcoming year.

- On consent from the policy holder, the amount of premium i.e. Rs. 436/- will be paid though autodebit mode from policy holder account in a single instalment.

- Any person who exited the scheme at any point of time can join again the scheme in near future.

- Pradhan Mantri Jeevan Jyoti Bima Yojana is exempted from GST.

- No need to submit health report or certificate to join Pradhan Mantri Jeevan Jyoti Bima Yojana.

- A person who crosses the age of 50 years cannot register himself under this scheme.

- However, a person who registered himself/ herself for this scheme under auto debit facility will have auto renewal up to the age of 55 years.

- It is mandatory to link person's Aadhar Card with his/her Bank/ Post Office account.

- Pradhan Mantri Jeevan Jyoti Bima Yojana can avail through by filling a form in the Bank Branch/ Post Office at any time in the year or the other mode is through netbanking facility.

- In case of death of a policy holder, the nominee can receive the amount of Rs. 2 Lac.

- If any person has multiple bank accounts then in that case he/ she can avail the benefit of the scheme from only single bank account of himself/ herself.

Conditions In Which No Claim Will Be Payable

- When beneficiary attain the age of 55 Years.

- Insufficient Balance in the Bank/ Post Office Account.

- Closure of Bank/ Post Office Account.

- When any person avail the benefit of same scheme through multiple bank accounts.

| Amount Of Premium Paid In Case Of Enrolment For The Scheme Is Delayed | |

|---|---|

| Enrolment Month | Premium To Be Paid |

| June, July and August | Full Amount Of Rs. 436/- |

| September, October and November | Prorata Premium Of Rs. 342/- |

| December, January and February | Prorata Premium Of Rs. 228/- |

| March, April and May | Prorata Premium Of Rs. 114/- |

Application Forms

- Pradhan Mantri Jeevan Jyoti Bima Yojana Application/ Enrolment Form according to the Languages of State are as follows :-

Claim Forms

- Following are the Claim Forms of Pradhan Mantri Jeevan Jyoti Bima Yojana in different languages :-

Important Links

- JanDhan se Jan Suraksha Website.

- Department Of Financial Services.

- Pradhan Mantri Jeevan Jyoti Bima Yojana Guidelines.

Contact Details

- National Toll Free Number :-

- 18001801111.

- 1800110001.

|

JANSURAKSHA State Wise Toll Free Numbers

|

||

|---|---|---|

| State Name | Name Of Convenor Bank | Toll Free Number |

| Andhra Pradesh | Andhra Bank | 18004258525 |

| Andaman & Nicobar Island |

State Bank Of India | 18003454545 |

| Arunachal Pradesh | State Bank Of India | 18003453616 |

| Assam | State Bank Of India | 18003453756 |

| Bihar | State Bank Of India | 18003456195 |

| Chandigarh | Punjab National Bank | 18001801111 |

| Chhattisgarh | State Bank of India | 18002334358 |

| Dadra & Nagar Haveli |

Dena Bank | 1800225885 |

| Daman & Diu | Dena Bank | 1800225885 |

| Delhi | Oriental Bank of Commerce | 18001800124 |

| Goa | State Bank of India | 18002333202 |

| Gujarat | Dena Bank | 1800225885 |

| Haryana | Punjab National Bank | 18001801111 |

| Himanchal Pradesh | UCO Bank | 18001808053 |

| Jharkhand | Bank of India | 18003456576 |

| Karnataka | Syndicate BankSLBC | 180042597777 |

| Kerala | Canara Bank | 180042511222 |

| Lakshadweep | Syndicate Bank | 180042597777 |

| Madhya Pradesh | Central Bank of India | 18002334035 |

| Maharashtra | Bank of Maharashtra | 18001022636 |

| Manipur | State Bank of India | 18003453858 |

| Meghalaya | State Bank of India | 1800 345 3658 |

| Mizoram | State Bank of India | 18003453660 |

| Nagaland | State Bank of India | 18003453708 |

| Odisha | UCO Bank | 18003456551 |

| Puducherry | Indian Bank | 180042500000 |

| Punjab | Punjab National Bank | 18001801111 |

| Rajasthan | Bank of Baroda | 18001806546 |

| Sikkim | State Bank of India | 18003453256 |

| Telangana | State Bank of Hyderabad | 18004258933 |

| Tamil Nadu | Indian Overseas Bank | 18004254415 |

| Uttar Pradesh | Bank of Baroda | 18001024455 |

| 1800223344 | ||

| Uttarakhand | State Bank of India | 18001804167 |

| West Bengal and Tripura |

United Bank of India | 18003453343 |

Ministry

| Caste | Person Type | Scheme Type | Govt |

|---|---|---|---|

Matching schemes for sector: Insurance

| Sno | CM | Scheme | Govt |

|---|---|---|---|

| 1 | Pradhan Mantri Suraksha Bima Yojana (PMSBY) | CENTRAL GOVT |

Comments

Very interesting

Very interesting

phle to pradhan mantri…

phle to pradhan mantri jeevan jyoti yojana me premium 330 rs tha ab 436 ho gya kya?

PMJJBY CLAIM 2 TIMES RETURN FROM POSTAL EMPLOYEES

Dear sir ,

Vijayapura division ,Kolhara so , Hangaragi Bo BPM death dated 08/05/2021 there claim 2times return

New account open

Shabina Ali kasu. New account open

Pmjjby scheme

Hlo sir mene ye pmjjby scheme band krane k bad be mere payment deduct ho gya to refund kaise milega

POLICY NEED TO CLAM 76001000438

NEED TO CLIAM PMJJY BIMA YOJANA OF MY FATHER PLESAE FIND BELOW DEATIALS

NAME = RAMACHANDRAPPA

POLICY NO= 76001000438

BRANCH = SBI VADANAKAL

IFSC= SBIN0006707

CAUSH OF DEATH = VIRAL FEVER AND BLED INFECTION

NAME OF NOMINEE = ERALINGAPPA

REALATIO OF NOMINEE= SON

ADRESS= LINGADAHALLI VILLAGE AND POST PAVAGADA TALLUK TUMAKUR DIS KARNATAKA

MOBLIE= 9945928570

Claim ka procedure kya hai

Claim ka procedure kya hai

Refund of Rs.114 deducted for PMJJBY

Hi,

Please note I have requested to close the PMJJBY policy hence kindly refund my Rs 114.00 back in my account.

The policy amount was deducted without any prior notification. And I do not require it. Discontinue request raised on 27-March-2023 and still awaiting that refund.

Customer id: 9360404

Account number : 20093920383

Requesting refund on priority.

Close policy and refund

Without my permission start policy

Close policy

Refund

बिना पूछे इंश्योरेंस कर दिया

मेरी पत्नी क्रांति रैकवार का बिना पूछे इंश्योरेंस कर दिया इसलिए मैं इंश्योरेंस बंद करना चाहता हूं

Close policy and refund

Without my permission start policy

Cancellation of pmjjby from my bank account

Kindly cancel the insurance this is a fraud scam of Modi, no use of this plan. Without my permission amount has been debited.

Pmjjby claim applied in icici bank but no money received

My brother named Gorle Tirupathi died in accident on 01.12.2022, claim applied in icici bank but money not received till today.

Pmjjby

Jagdishprasadnager ka pmjjby claim cbi branch dholam codecbin0282915 jo abitaknahiaaya from champalal

My Husband Manish jhas death claim still pending in Bank

My husband PMJJY DEATH CLAIM (CaseId : 2308090291xx).i have registered complain in Axisbank nodal officer .this is the reference number .its been 15 days now .no revert received.kindly give me some solution.thanks

Mpjjby Claim is delayed

Dear sir

My husband was passed away and he have pmjjby and pmsby policy no:LICBR085217042000xxx in UCO Bank dhekiajuli branch (Assam) he expire on 18/11/2021 deu to brain stroke.we have apply 3 time for claim in UCO bank with all necessary documents but till date we have not received payment on nominee account.

We have contacted the bank thet told we have already send all your documents to respective insurance company.at president what can we do please do needfuly action.

Thanking you

Nominee name-khiroda jena

Vill-natun Singri

PO - natun sirajuli

Pin-784110

Dist-sonitpur (Assam)

A/c no -0852321111xxxx

Discharge

Name-raghu nath das

A/c no -0852321108xxxx

Refund of Rs.342 cancellation of pmjjby

Hi,

Please note I have requested to close the PMJJBY policy hence kindly refund my Rs 342.00 back in my account.

The policy amount was deducted without any prior notification. And I do not require it.

Account number : 13290110067xxx

Requesting refund on priority.

is there any online…

is there any online registration process of jeevan jyoti bima yojana

Insurance cover

Hello sir Meri maata ji ke death ho chuki hai aur central bank of India me account hai aur unka pmjjby ka dwara insurance hai maine 6 month pahale bank me insurance claim kiya hai aur abhi tak koi information ya claim nahi mila hai an Kya Kare please any replay

436 pmjjby

Amarjeet Kumar BABHANGAMA

Looking forward to help

Looking forward to help

Add new comment