Highlights

- Assured Pension according to last pay.

- Guaranteed Minimum Pension.

- Family Pension in Case of Employee Death.

- Lump Sump Amount in addition to Gratuity.

- Inflation Indexation of Pension Amount.

Customer Care

- Pension Grievances Toll Free Number :- 1800111960

- Pension Grievances Helpdesk Email :- care.dppw@nic.in.

| Overview of the Scheme

|

|

|---|---|

| Name of Scheme | Central Government's Unified Pension Scheme. |

| Launched Date | 01-04-2025. |

| Benefits |

|

| Beneficiaries | Central Government Employee. |

| Nodal Department | Department of Pension and Pensioners Welfare. |

| Subscription | Subscribe Here to Get Scheme Updates. |

| Mode of Apply | No Need to Apply for Unified Pension Scheme. |

Introduction

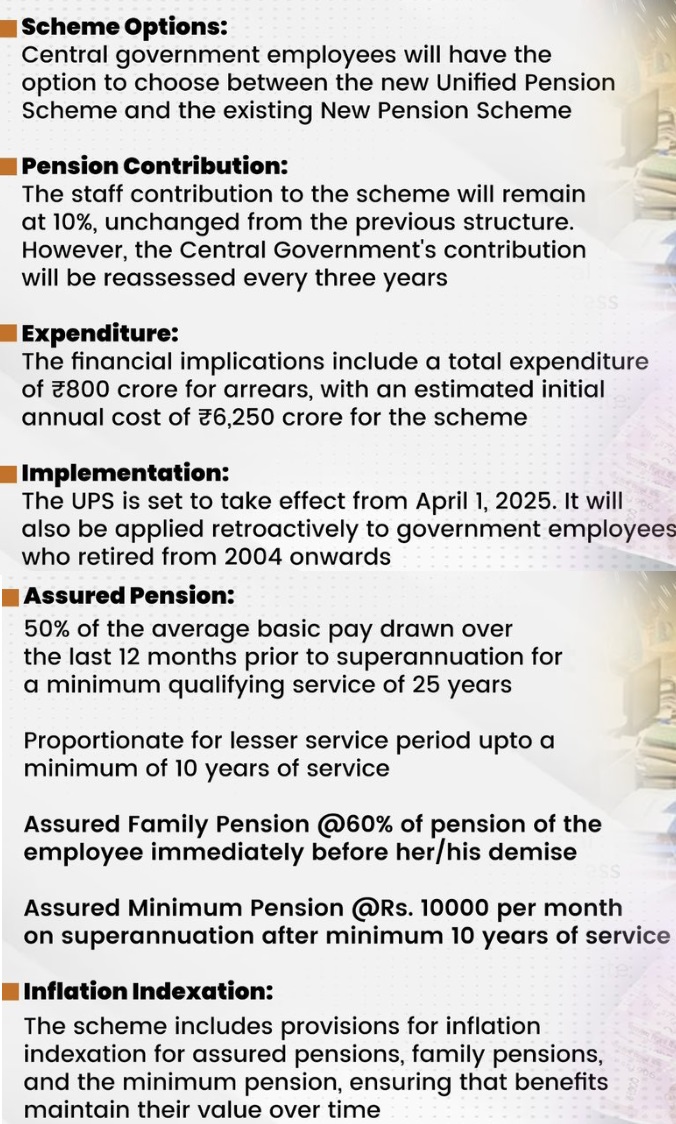

- Prime Minister Shri Narendra Modi chaired the cabinet meeting on 24th of August 2024.

- The main agenda of that cabinet meeting is to discuss and approval of Unified Pension Scheme for Central Government Employees.

- Finally on 24-08-2024, Cabinet gave its nod to implement Unified Pension Scheme for Employees of Central Government.

- Before UPS (Unified Pension Scheme), Central Government Employees comes under New Pension Scheme which implemented on 14-01-2004.

- New Pension Scheme has 2 Tiers in which Government Employee has to make a mandatory contribution of 10% of his Basic Pay+DP+DA.

- Government of India also contributed same amount in proportion which is extended to 14% and now the contribution of Central Government is further extended to 18.5%.

- Some Central Government Employee opposes this New Pension Scheme and demanded to implement Old Pension Scheme.

- To meet their demand, Indian Government launched Unified Pension Scheme which has same features like Old Age Pension Scheme.

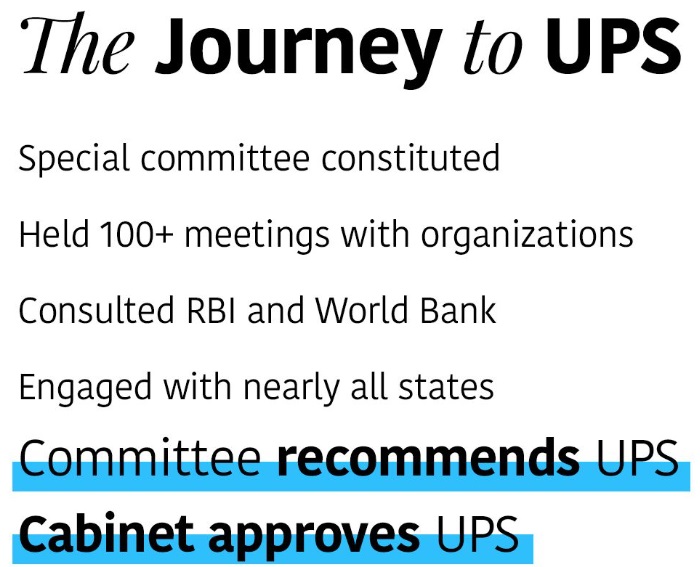

- Unified Pension Scheme is just not a random decision of Government of India.

- This pension scheme is drafted after Government constituted a special committee, held 100s of meeting with organizations, done a consultation with RBI and World Bank, discussed with all States then gave its approval to implement it.

- Unified Pension Scheme will officially going to launch on April 1st 2024 from the next financial year.

- Department of Pension and Pensioners Welfare is the nodal department of this scheme.

- More than 23 lakh employees of Central Government will going get benefit of Unified Pension Scheme (UPS).

- Unified Pension Scheme has 5 categories according to which they get benefitted after retirement from service.

- The 5 Categories of Benefit of Unified Pension Scheme are as follows :-

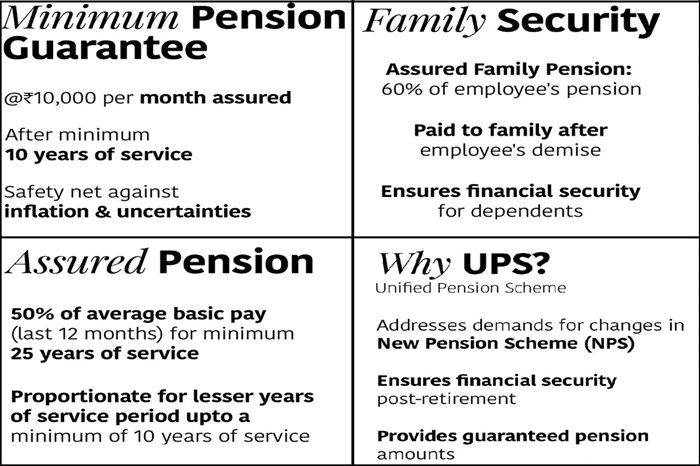

- Assured Pension :- Applicable after 25 years of service after which employee will get 50% of average basic pay as a pension.

- Family Pension :- 60% of Immediate Pension to Family in case of death of retired employee.

- Guaranteed Pension :- Rs. 10,000/- per Month Guaranteed Pension if employee retired after completing 10 years of service.

- Inflation Indexation :- Pension Amount will increase according to the inflation rate.

- Lump Sump Amount :- In addition to Gratuity, A One Time Lump Sump Amount will also provided which is 1/10th of Monthly Salary.

- All permanent employees of Central Government are eligible under Unified Pension Scheme.

- State Government can also adopt this method of pension for their employees to provide more benefits.

- According to sources, Maharashtra is the first state which opt Unified Pension Scheme for their employees.

- If all State opt UPS as pension method for their employee then the total number Unified Pension Beneficiary will be around more than 1 Crore.

- No Need to apply to get enroll in Unified Pension Scheme, all central government employee are automatically eligible under this pension scheme.

- Employees can also opt to stay in New Pension Scheme, Unified Pension Scheme is optional.

- If any central government employee opt for VRS (Voluntary Retirement Services) and get an early retirement before completing 10 years of service, then those employees are not eligible under Unified Pension Scheme.

- Remaining details about Unified Pension Scheme will be soon released by Central Government.

Benefits of Scheme

- Indian Government will provide the following benefits to its employees under new Unified Pension Scheme :-

Category of Benefit Benefits Assured Pension - Beneficiary will receive Assured Pension if retired after completing 25 years in service.

- Assured Pension of 50% of average basic pay drawn over last 12 months before retirement will be provided as pension.

- Proportionate Pension will be provided if Employee retired before completing the 25 years of service.

Guarantee of Minimum Pension - Fixed Monthly Pension of Rs. 10,000/- per Month.

- This Pension Amount will be provided to those employees who retired after completing 10 years of service.

Spouse/ Family Pension - Family Pension will be provided in case of untimely demise of retired employee.

- Spouse will receive Guaranteed 60% of Pension which was receiving by employee before passing away.

Inflation Indexation - Family Pension and Assured Pension will be adjusted by Government according to Inflation.

- This will increase the pension amount according to the living cost.

One Time Lump Sump Payment - One Time Lump Sump Amount will also provided to employee at the time of retirement.

- Lump Sump Amount will be 1/10th of Monthly Salary (Basic+DA) for every completed six months of service.

Eligibility Criteria

- Only those Central Government Employee are eligible to avail the new pension benefits who fulfil the following eligibility criteria of Unified Pension Scheme :-

- Applicant should be Central Government Employee.

- Applicant Service Tenure should be minimum 25 Years. (For Long Term Service Assured Pension)

- Applicant Service Tenure should be minimum 10 Years. (For Minimum Pension Guarantee)

Documents Required

- Documents that are required to be submitted by the Employee at the time of starting his/ her pension under Unified Pension Scheme are as follows :-

- Aadhar Card.

- PAN Card.

- Mobile Number.

- Employee Number.

- Retirement Letter from Department.

How to Apply

- As Unified Pension Scheme is specifically for the Employees of Central Government, so there is no need to apply separately for Unified Pension Scheme.

- All Central Government Employees are automatically eligible under Government's new Unified Pension Scheme. (UPS)

- This pension scheme will going to implement from next financial year i.e. from April 1, 2025.

- Central Government Employees doesn't have any need to fill any Application Form of Unified Pension Scheme in orderto get enrolled.

- However to start pension after compulsory retirement, voluntary retirement or after the death of a employee, there is a need to apply.

- Beneficiary will have to submit an application for pension in the department office where he/ she was working.

- Department Officials will scrutinized the application form and documents.

- After approval, Beneficiary will receive the benefit of Unified Pension Scheme as per the category.

Important Links

- Unified Pension Scheme Guidelines.

- Centralized Pension Greivance Redress and Monitoring System.

- Depatment of Pension and Pensioners Welfare.

Contact Details

- Pension Grievances Toll Free Number :- 1800111960

- Pension Grievances Helpdesk Email :- care.dppw@nic.in.

- Department of Pension and Pensioners Welfare,

Janpath Bhawan,

B Wing, 8th Floor,

New Delhi - 110001.

Scheme Forum

| Person Type | Govt |

|---|---|

Subscribe to Our Scheme

×

Stay updated with the latest information about Unified Pension Scheme (UPS)

Add new comment