Highlights

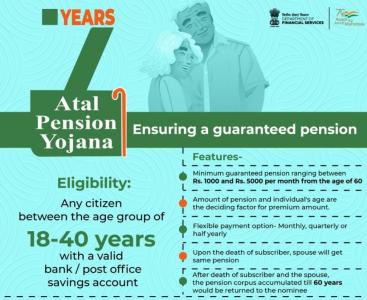

- Guaranteed Minimum Monthly Pension ranging between Rs. 1000/- to Rs. 5000/- per Month.

- Central Government will also co-contribute 50% of the subscriber’s contribution or Rs. 1000 per year which ever is lower

- Any Person of 18 Years to 40 Years of Age can Contribute in Atal Pension Yojana.

Customer Care

- Atal Pension Yojana Helpline Number :-

- 18008891030.

- 1800110069.

- National Toll Free Number of Atal Pension Yojana :-

- 18001801111.

- 1800110001.

Information Brochure

|

Overview Of The Scheme

|

|

|---|---|

| Name Of Scheme | Atal Pension Yojana (APY). |

| Launched Date | 09-05-2015. |

| Scheme Type | Monthly Pension Scheme. |

| Nodal Ministry | Department of Financial Services. |

| Official Website | Jan-Dhan Se Jan Suraksha Portal. |

| Pension Range | Rs. 1,000/ to Rs. 5,000/ |

| Maximum Contribution Period | 42 Years (When a person subscribe the scheme at the age of 18 years.) |

| Minimum Contribution Period | 20 Years (When a person subscribe the scheme at the age of 40 years.) |

| Mode Of Apply | Offline/ Online Mode Available Through The Banks. |

Introduction

- Atal Pension Yojana is a Monthly Pension Scheme of Department Of Financial Services under the Ministry Of Finance.

- It came into effect from 1st Of June 2015.

- Atal Pension Yojana is a voluntary and periodic contribution based pension scheme.

- Minimum Guaranteed Monthly Pension of Rs. 1,000, or Rs. 2,000, or Rs. 3,000, or Rs. 4,000, or Rs. 5,000 per month will be provided by Government of India under Atal Pension Yojana.

- Monthly Pension Amount received by subscriber is subject to contribution plan taken by him/ her.

- Pension under Atal Pension Yojana will starts when a person attain the age of 60 years.

- Pension Regulatory and Development Authority (PFRDA) administered the Atal Pension Yojana.

- Central Government will also contributed the same amount as contributed by the beneficiary.

- Subscriber of Atal Pension Yojana choose to contribute premium amount on Monthly, Quarterly and Half Yearly basis.

- Pension under Atal Pension Yojana will be provided to subscriber till his/ her death.

- Subscriber can also withdraw the whole contributed amount of Atal Pension Yojana anytime.

- Eligible Beneficiary can appy for Atal Pension Yojana by visiting any nearest Bank Branch.

Benefits

- Following benefits are available for the Subscribers of Atal Pension Yojana :-

- Per Month Pension of Rs. 1,000/- to Rs. 5,000/-

- Central Government also contributed the same amount as contrubuted by the Subscriber.

- Pension will be Provided to Spouse in case of death of Pension Subscriber.

- If Pension Subscriber dies before attaining the age of 60 years, Spouse can choose any one option :-

- Withdraw the Entire Corpus Amount.

- Continue Contribution and Avail the Pension after Spouse turns 60 Years.

- Spouse of Original Subscriber will then receive pension till her/ his death.

- In case of death of both the Subscriber and his/ her spouse, the nominee mentioned by the subscriber gets the accumulated amount contributed by the subscriber.

Eligibility Criteria

- Beneficiary should be a Indian Resident.

- The Age of Beneficiary should be between 18 Years to 40 Years.

- Beneficiary should have Jandhan Bank Account or Saving Bank Account.

- Bank Account of Beneficiary should be linked with Aadhar Number and Mobile Number.

Key Features Of The Scheme

- Atal Pension Yojana is a social security scheme for all the citizens of India especially working in unorganized sector.

- It focused on working poor to encourage them to save for their old age.

- It's aim to encourage the workers of unorganized sector to voluntarily save for their retirement.

- On consent from the policy holder, the amount of contribution will be paid through autodebit mode from policy holder's account in a single installment.

- It is mandatory to make contribution in Atal Pension Yojana continuously from the age of joining to till the age of 60 years of the subscriber.

- A person who crosses the age of 40 years cannot register himself under Atal Pension Yojana.

- It is essential to link person's Aadhar Card and Mobile Number For Updates with his/her Bank Account.

- Enrollment under Atal Pension Yojana can avail through by filling a form in the Bank Branch at any time in the year.

- Some Banks also gave facility to their customers to apply online for Atal Pension Yojana.

- Through National Pension System Trust Portal, any person can Register himself/ herself to avail the benefit of Atal Pension Yojana.

Late Contribution Amount Charges Charged By Bank

- If any person under the Atal Pension Yojana delayed his/ her Monthly/ Quarterly/ HalfYearly contribution payments then Banks collects additional amount/ charges for delayed payments.

Contribution By A Person Amount Charged

by BankRs. 100/- per month. Rs. 1/- per month. Upto Rs. 101/- to Rs. 500/- per month. Rs. 2/- per month. Between Rs. 501/- to Rs. 1000/- per month. Rs. 5/- per month. Beyond Rs. 1001/- per month. Rs. 10/- per month. - If Subscriber Delayed Pension Premium Contribution of Atal Pension Yojana for a very long period of time then the Course Of Action Taken By Banks are as follows :-

Delayed Time Period Action Take For 6 Months Account Will Be Frozen For 12 Months Account Will Be Deactivated For 24 Months Account Will Be Closed

Exit Guidelines Of Atal Pension Yojana

- Exit from Atal Pension Yojana before 60 years is not permitted.

- However, it is permitted only in exceptional circumstances for e.g. in the event of the death of the subscriber or in case of any terminal disease or specified illness.

- After attaining the age of 60 years exit from Atal Pension Yojana is permitted with 100 % annuitisation of pension wealth.

- Pension under Atal Pension Yojana starts when Beneficiary attain the Age of 60 Years.

- In case of exit due to the death of the subscriber, pension would be available to the spouse of the subscriber.

- In case of death of both the subscriber and the spouse, the pension corpus/ amount of Atal Pension Yojana would be returned to the nominee.

Monthly Contribution Under Atal Pension Yojana

- Beneficiary Contribution on Monthly Basis under Atal Pension Yojana are as follows :-

Pension Of

Rs. 1000/-

per monthPension Of

Rs. 2000/-

per monthPension Of

Rs. 3000/-

per monthPension Of

Rs. 4000/-

per monthPension Of

Rs. 5000/-

per monthReturn Of Corpus

AmountTo

The NomineeRs.1.7 Lakh Rs. 3.4 Lakh Rs. 5.1 Lakh Rs. 6.8 Lakh Rs. 8.5 Lakh Age Of

EntryPeriod Of

Contribution

(In Years)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)18 42 42 84 126 168 210 19 41 46 92 138 183 228 20 40 50 100 150 198 248 21 39 54 108 162 215 269 22 38 59 117 177 234 292 23 37 64 127 192 254 318 24 36 70 139 208 277 346 25 35 76 151 226 301 376 26 34 82 164 246 327 409 27 33 90 178 268 356 446 28 32 97 194 292 388 485 29 31 106 212 318 423 529 30 30 116 231 347 462 577 31 29 126 252 379 504 630 32 28 138 276 414 551 689 33 27 151 302 453 602 752 34 26 165 330 495 659 824 35 25 181 362 543 722 902 36 24 198 396 594 792 990 37 23 218 436 654 870 1087 38 22 240 480 720 957 1196 39 21 264 528 792 1054 1318 40 20 291 582 873 1164 1454

Quarterly Contribution Under Atal Pension Yojana

- Beneficiary Contribution on Quarterly Basic under Atal Pension Yojana are as follows :-

Pension Of

Rs. 1000/-

per monthPension Of

Rs. 2000/-

per monthPension Of

Rs. 3000/-

per monthPension Of

Rs. 4000/-

per monthPension Of

Rs. 5000/-

per monthReturn Of Corpus

AmountTo

The NomineeRs.1.7 Lakh Rs. 3.4 Lakh Rs. 5.1 Lakh Rs. 6.8 Lakh Rs. 8.5 Lakh Age Of

EntryPeriod Of

Contribution

(In Years)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)18 42 125 250 376 501 626 19 41 137 274 411 545 679 20 40 149 298 447 590 739 21 39 161 322 483 641 802 22 38 176 349 527 697 870 23 37 191 378 572 757 948 24 36 209 414 620 826 1031 25 35 226 450 674 897 1121 26 34 244 489 733 975 1219 27 33 268 530 799 1061 1329 28 32 289 578 870 1156 1445 29 31 316 632 948 1261 1577 30 30 346 688 1034 1377 1720 31 29 376 751 1129 1502 1878 32 28 411 823 1234 1642 2053 33 27 450 900 1350 1794 2241 34 26 492 983 1475 1964 2456 35 25 539 1079 1618 2152 2688 36 24 590 1180 1770 2360 2950 37 23 650 1299 1949 2593 3239 38 22 715 1430 2146 2852 3564 39 21 787 1574 2360 3141 3928 40 20 867 1734 2602 3469 4333

Half Yearly Contribution Under Atal Pension Yojana

- Beneficiary Contribution on Half Yearly basis under Atal Pension Yojana are as follows :-

Pension Of

Rs. 1000/-

per monthPension Of

Rs. 2000/-

per monthPension Of

Rs. 3000/-

per monthPension Of

Rs. 4000/-

per monthPension Of

Rs. 5000/-

per monthReturn Of Corpus

AmountTo

The NomineeRs.1.7 Lakh Rs. 3.4 Lakh Rs. 5.1 Lakh Rs. 6.8 Lakh Rs. 8.5 Lakh Age Of

EntryPeriod Of

Contribution

(In Years)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)Half Yearly

Contribution

(In Rs.)18 42 248 496 744 991 1239 19 41 271 543 814 1080 1346 20 40 295 590 885 1169 1464 21 39 319 637 956 1269 1588 22 38 348 690 1045 1381 1723 23 37 378 749 1133 1499 1877 24 36 413 820 1228 1635 2042 25 35 449 891 1334 1776 2219 26 34 484 968 1452 1930 2414 27 33 531 1050 1582 2101 2632 28 32 572 1145 1723 2290 2862 29 31 626 1251 1877 1496 3122 30 30 685 1363 2048 2727 3405 31 29 744 1487 2237 2974 3718 32 28 814 1629 2443 3252 4066 33 27 891 1782 2673 3553 4438 34 26 974 1948 2921 3889 4863 35 25 1068 2136 3205 4261 5323 36 24 1169 2337 3506 4674 5843 37 23 1287 2573 3860 5134 6415 38 22 1416 2833 4249 5648 7058 39 21 1558 3116 4674 6220 7778 40 20 1717 3435 5152 6869 8581

Application Forms

- Atal Pension Yojana English Form 1.

- Atal Pension Yojana English Form 2.

- Atal Pension Yojana Hindi (हिन्दी) Form.

- Atal Pension Yojana Bangla (বাংলা) Form.

- Atal Pension Yojana Gujarati (ગુજરાતી) Form.

- Atal Pension Yojana Kannada (ಕನ್ನಡ)F orm.

- Atal Pension Yojana Marathi (मराठी) Form.

- Atal Pension Yojana Odia (ଓଡ଼ିଆ) Form.

- Atal Pension Yojana Tamil (தமிழ்) Form.

- Atal Pension Yojana Telugu (తెలుగు) Form.

- Atal Pension Yojana Department Of Post Form (English).

- Atal Pension Yojana Account Closure Form (Death Case).

- Atal Pension Yojana Account Closure Form (Voluntary Exit).

- Atal Pension Yojana APY Modification Form.

- Atal Pension Yojana Aadhar Seeding Consent Form.

Important Links

- Atal Pension Yojana Online Registration.

- Jan-Dhan se Jan Suraksha Portal.

- Department Of Financial Services

- Atal Pension Yojana Guidelines.

- National Pension System Trust.

- Atal Pension Yojana Guidelines.

- Atal Pension Yojana FAQs.

Contact Details

- Atal Pension Yojana Helpline Number :-

- 18008891030.

- 1800110069.

- National Toll Free Number of Atal Pension Yojana :-

- 18001801111.

- 1800110001.

State Toll Free Numbers of Atal Pension Yojana

- Following are the State Wise Toll Free Numbers of Atal Pension Yojana :-

State Name Convenor Bank Toll Free

NumberAndhra Pradesh Andhra Bank 18004258525 Andaman & Nicobar Island State Bank Of India 18003454545 Arunachal Pradesh State Bank Of India 18003453616 Assam State Bank Of India 18003453756 Bihar State Bank Of India 18003456195 Chandigarh Punjab National Bank 18001801111 Chhattisgarh State Bank of India 18002334358 Dadra & Nagar Haveli Dena Bank 1800225885 Daman & Diu Dena Bank 1800225885 Delhi Oriental Bank of Commerce 18001800124 Goa State Bank of India 18002333202 Gujarat Dena Bank 1800225885 Haryana Punjab National Bank 18001801111 Himachal Pradesh UCO Bank 18001808053 Jharkhand Bank of India 18003456576 Karnataka Syndicate BankSLBC 180042597777 Kerala Canara Bank 180042511222 Lakshadweep Syndicate Bank 180042597777 Madhya Pradesh Central Bank of India 18002334035 Maharashtra Bank of Maharashtra 18001022636 Manipur State Bank of India 18003453858 Meghalaya State Bank of India 1800 345 3658 Mizoram State Bank of India 18003453660 Nagaland State Bank of India 18003453708 Odisha UCO Bank 18003456551 Puducherry Indian Bank 180042500000 Punjab Punjab National Bank 18001801111 Rajasthan Bank of Baroda 18001806546 Sikkim State Bank of India 18003453256 Telangana State Bank of Hyderabad 18004258933 Tamil Nadu Indian Overseas Bank 18004254415 Uttar Pradesh Bank of Baroda 18001024455 1800223344 Uttarakhand State Bank of India 18001804167 West Bengal and Tripura United Bank of India 18003453343

Ministry

| Caste | Person Type | Scheme Type | Govt |

|---|---|---|---|

Matching schemes for sector: Pension

| Sno | CM | Scheme | Govt |

|---|---|---|---|

| 1 | National Pension System | CENTRAL GOVT | |

| 2 | Pradhan Mantri Laghu Vyapari Mandhan Yojana(PMLVMY) | CENTRAL GOVT | |

| 3 | Pradhan Mantri Vaya Vandana Yojana | CENTRAL GOVT |

Comments

I am an NRI shifted to india…

I am an NRI shifted to india permanently. Can i eligible?

revnue generate krne ke liye…

revnue generate krne ke liye government ki trick hai bs

that is the same thing i…

that is the same thing i though would be about this scheme. this is purely a income generation scheme of the government.

Kl ka pta nhi aur hm 60 ka…

Kl ka pta nhi aur hm 60 ka wait kre

itna wait kn h krega

itna wait kn h krega

insured ki death ho jaane ke…

insured ki death ho jaane ke baad lgbhg kitna paisa nominee ko mil payega?

Dear govtschemes.in…

Dear govtschemes.in administrator, Thanks for the well written post!

my father is passed away…

my father is passed away. what about the amount he contribute where i can claim it?

want to cancel the auto…

want to cancel the auto debit from my account of this scheme tell me the procedure

अटल पेंशन योजना में कितना…

अटल पेंशन योजना में कितना पैसा कटता है

বযস্ক ভাতা

আমার বাবা গনেশ হাতি বয়স ৬৭& আমার মা মেনকা হাতি বয়স৬২, বারবার দরখাস্ত জমা দিয়ে কোনো ভালো হয়নি

atal pension yojana want to…

atal pension yojana want to close the account

Want to close atal pension…

Want to close atal pension Yojana

Add new comment